Unified Ever given that PM Narendra Modi demonetized 500 and one thousand rupees notes. Offerings like digital wallets have become pretty popular; Paytm being the pinnacle one on the list. But wait, there is also a brand new youngster in the town called – UPI, short for Unified Payment Interface. So, what precisely is UPI, how does it paintings, and how can or not it’s a sport changer? Well, allow’s find out.

Related: Everything You Need to Know About Paytm Wallet

Day earlier than the day before today, State Bank of India released their first UPI app; which according to them. could be a game-changer within the contemporary financial state of affairs of demonetization. And we consider them. SBI has India’s largest customer base. And with the aid of joining hands with 30 other Indian banks. UPI would possibly trade the manner banking is achieved in India.

Author’s Note:

This is a extraordinarily researched article, and after you make it to the stop. You may have a crystal clean Idea of what UPI can do and what it is able to’t. So, please examine it carefully and here we go.

So, what exactly is UPI?

UPI (brief for Unified Payments Interface) in simple words. Is a web price gadget which lets you transfer cash for your buddy. (or every person) the use of your phone. Now, I know, what you are thinking. One also can switch price range with the cellphone the usage of online banking and Paytm, proper? So, how is UPI extraordinary?

If you transfer money via on line banking (i.E. NEFT or IMPS), you need to realize the beneficiary’s account number and IFS Code. Not to forget, it also takes a while to feature a new beneficiary and switch funds.

Paytm, then again, is easy. Enter the character’s cellular quantity and the budget are transferred straight away. No need to attend or input the complex account number. But, a large trouble with it. The cash you received from Paytm goes for your Patym wallet and now not your financial institution account. Yes, you could transfer that cash from your Paytm wallet for your bank account. But that takes time, and there’s a large transaction rate (four% normally, however it’s miles at 1% proper now).

And this is where UPI comes into the photo. With UPI, you may switch finances via knowing the beneficiary’s cell range. OR VPA and the quantity goes immediately from your financial institution account for your buddy’s financial institution account. No 1/3 birthday party pockets is worried. Best of both worlds.

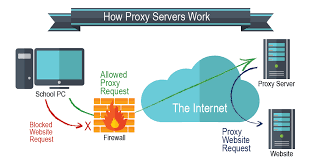

Unified, How UPI works?

Here is the way it works, you download the UPI app. For App Store > open it > input the beneficiary’s VPA (the Virtual Payment Address. That is like an electronic mail cope with in your bank account) > confirm the amount > press ship. And that’s it. You have effectively transferred the money to that man or woman’s bank account.

So, you notice, to ship and acquire cash thru UPI. You don’t need additional financial institution account information. Like you want to during IMPS, RTGS, etc. UPI also can be used to pay merchants who receive UPI as a charge mode. Similar to you could with cell wallets which includes Paytm. And sure, UPI is subsidized by way of the Indian executive i.E. NPCI (National Payment Corporation of India).

What are the advantages of UPI over NEFT, IMPS, and RTGS?

Unlike NEFT and RTGS, UPI is available 24×7. You can transact even on public holidays, or at 3 am whilst your younger brother asks you for pressing cash.

With UPI, you could easily pay to merchants (obviously who be given it) without delay out of your bank account. Without inputting your card info, internet banking ID/password, and so forth.

There is likewise no need of including a beneficiary whenever you want to send money to a new birthday party. All you need is their VPA (which is simple to consider), and you’re prepared to go.

What are the advantages of UPI over mobile wallets like Paytm?

Unlike the net wallets, with UPI, your cash is for your bank account. And you get the hobby for that as long it’s there, which isn’t the case with the online wallet.

UPI additionally has higher protection. You don’t have to fear approximately the protection of your UPI account. In case it gets hacked since it uses -issue authentification. So, with out your cellular number or MPIN, the information is useless for a hacker. It can’t be accessed from any website, like other E-Wallets.

Topping up your UPI wallet is also no longer a trouble as it’s without delay connected. In your financial institution account, and all of the finances are always to be had.

Also, there is no monthly limit for transactions which is set to ₹20,000. For wallets such as Paytm (KYC increases this limit).

Can any Bank’s UPI app be downloaded for use?

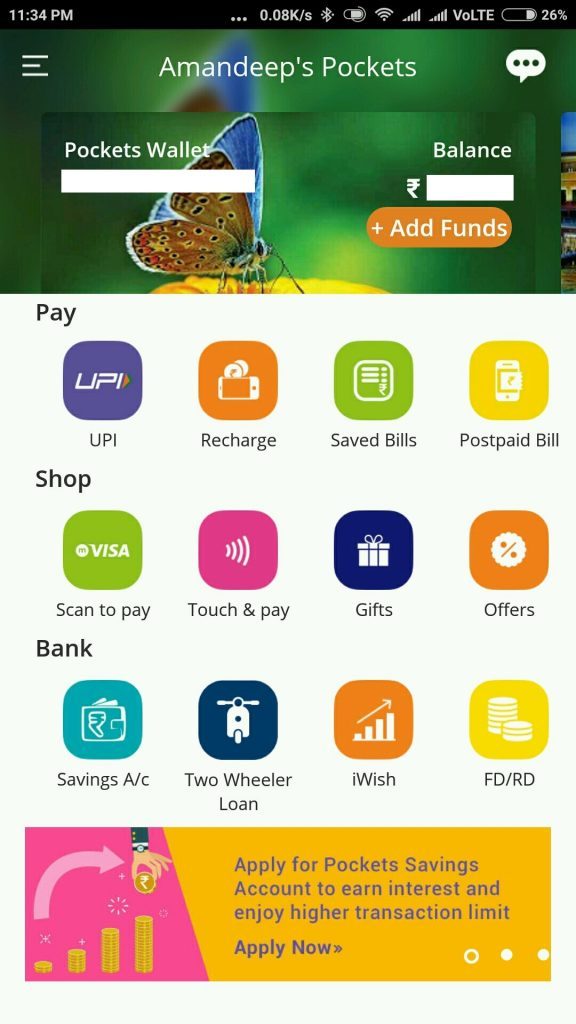

Yes. There are lots of apps for UPI access. And anyone of them may be used to transact the use of UPI. For example, you could use ICICI Bank’s app ‘Pockets’ to transact the usage of your SBI account.

A few of the apps from the popular banks are:

ICICI – Pockets HDFC – HDFC Bank MobileBanking SBI – SBI Pay Axis Bank – Axis Pay

Note: Make sure you update your app from the Play Store.

Unified, How do I get started with using UPI?

There are a few requirements for using UPI such as –

1. Android smartphone with active Internet connection.

2. A Debit card relating to this bank account

3. A mobile number linked to the aforementioned bank account. One SMS will be sent from your mobile number, so make sure you have sufficient balance.

Note: None of the UPI apps work on rooted Android phones for security reasons.

Once you have all these requirements fulfilled, you are good to go.

Firstly you have to create your unique VPA (Virtual Payment Address).

For this example, we’ll see the way to create a VPA on ICICI Pockets app. (ICICI bank’s cellular app) the use of an SBI account. But the stairs have to be similar for other banking apps as well.

01: Open ICICI Pockets. The first time you open the app, you will be required to set an MPIN. Also, an SMS will be sent from your mobile number for verification.

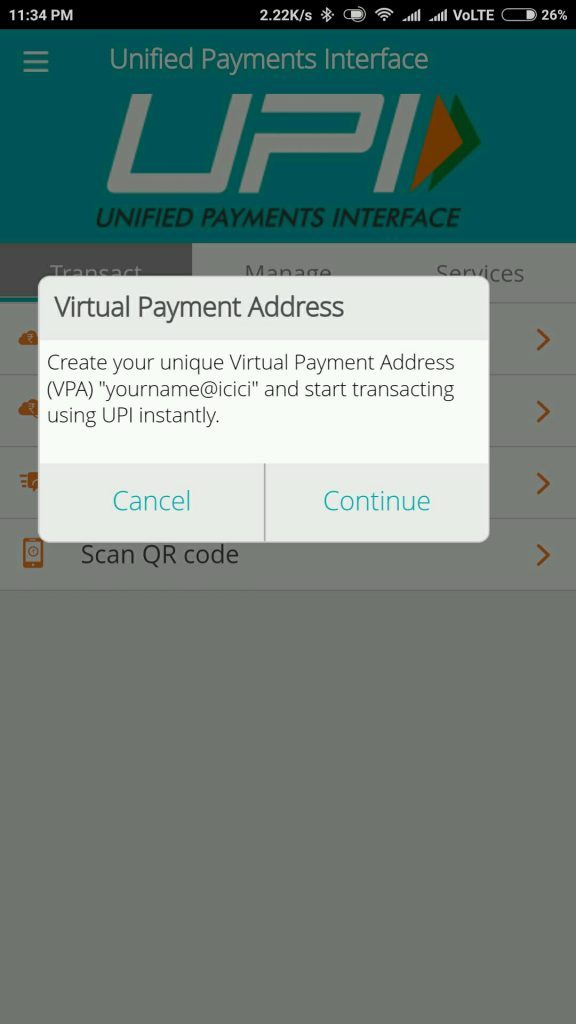

02: Click on ‘Continue‘ to create a unique Virtual Payment Address (VPA).

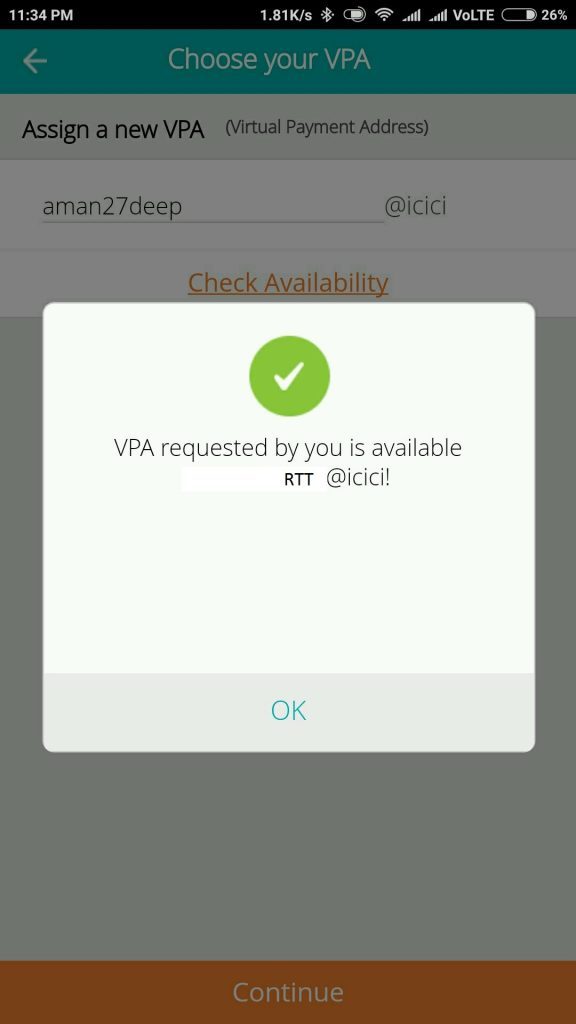

03: Choose a VPA and check if it’s available.

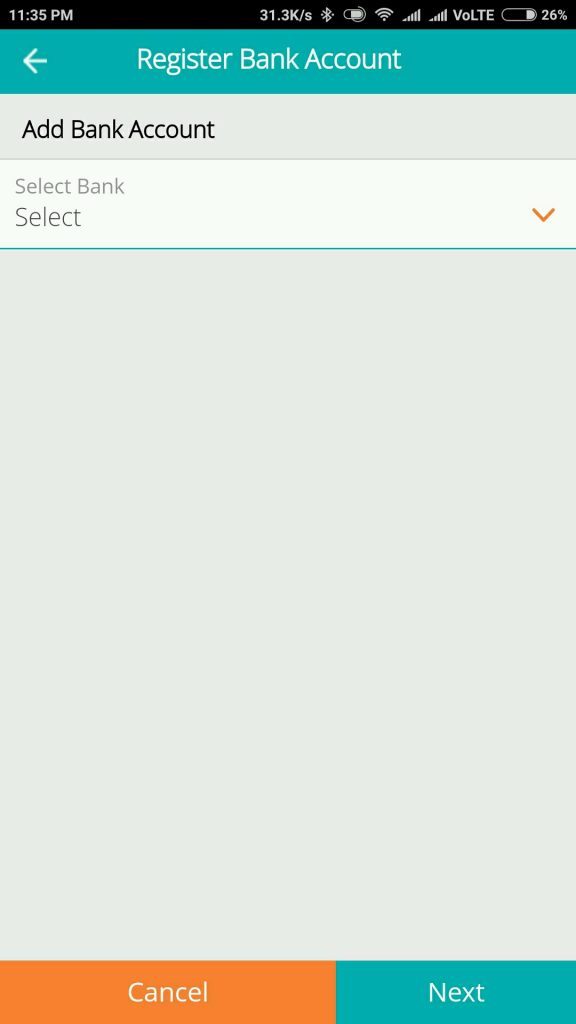

04: Select your Bank from the list.

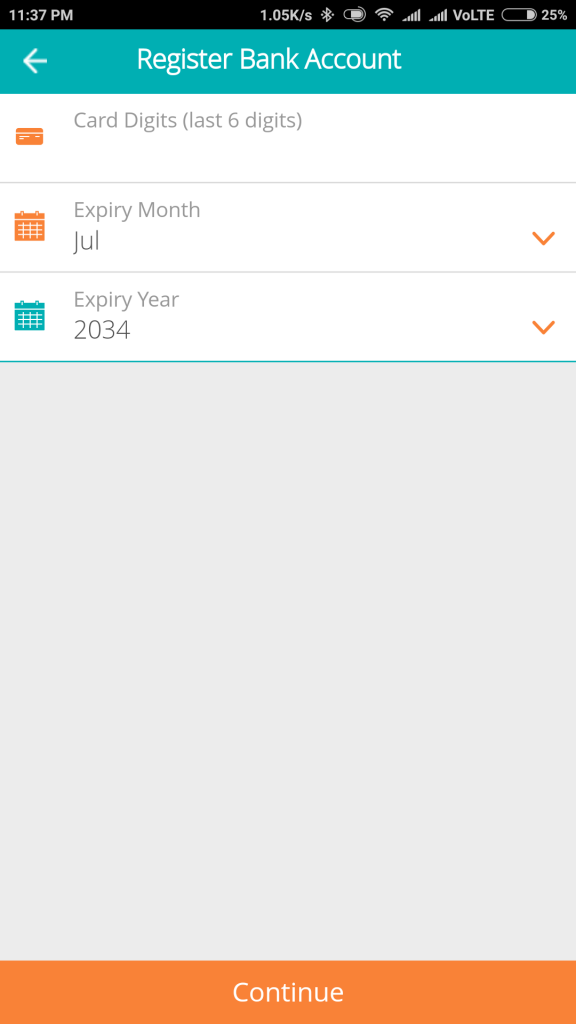

05: Then register that bank account using your debit/credit card information.

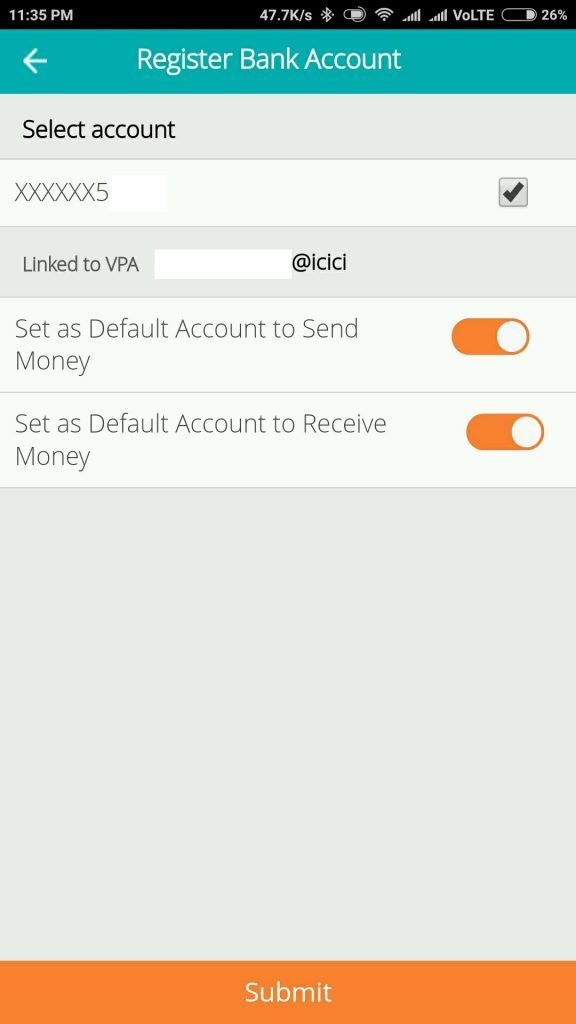

06: Choose your default account for transactions.

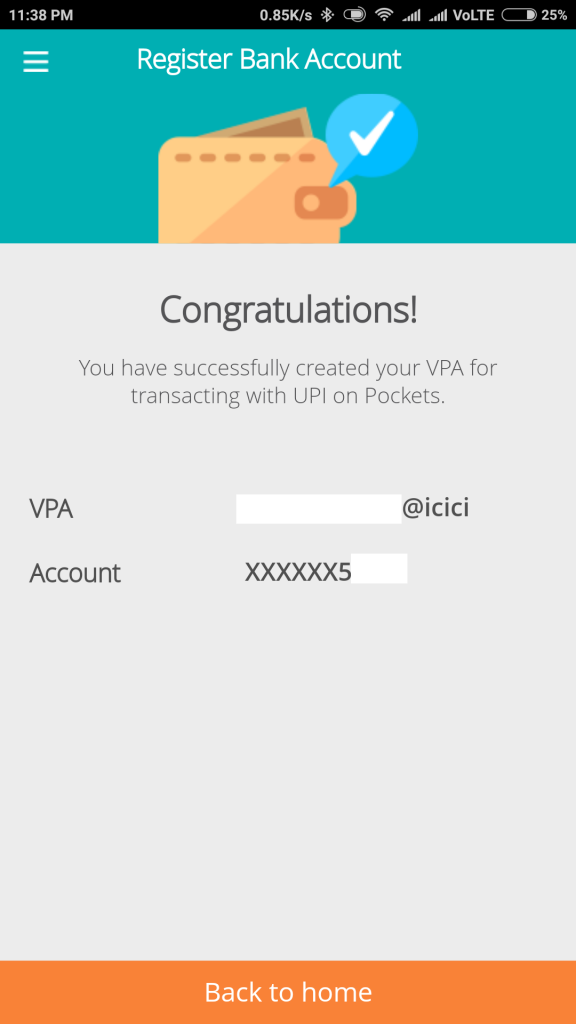

08: After submitting, you’ll be all done – and can now begin transacting using UPI.

What transactions can I perform via UPI?

Unified Transactions are presently restrained to transfers. Between one of a kind financial institution accounts in the shape of VPA to VPA transfers. But, there can be more in destiny as UPI penetration goes deeper in India.

Can you link more than one bank account to a VPA?

Unified Yes, you could. You need to pick your current VPA at the same time as linking your new bank account. If you select to link any other account to a VPA. Then you need to also select one specific account to be your default for sending and receiving payments.

Is there a transaction limit for UPI?

Yes, right now the transaction restrict is set at ₹1,00,000. This restriction is in keeping with transaction based. So you can carry out more than one transactions a day in case you need to.

Unified, Are there any charges for transactions done via UPI?

No, right now there aren’t any charges for transactions finished via UPI. But there can be a rate within the destiny. As initially it was announced by way of NCPI. That they could be charging a flat fee of zero.50 according to transaction.

Again, this is way much less than what NEFT/IMPS fee (commonly 5.75 Rs). And receiving money from Paytm pockets to bank account. (Typically four% of the overall amount for non-VIP customers).

What security protocols are being taken care of?

Nandan Nilekani, the advisor to NPCI, has said that the safety that’s being used by UPI is idiot-proof. And the transactions will take vicinity in a especially encrypted format. The same technology is being used by NPCI’s IMPS community. Which already handles more than Rs.8,000 crore well worth of transactions consistent with day. And this figure is most effective set to increase with UPI becoming popular.

Is my money at risk if I lose my mobile phone?

No, all debts are set to adhere to RBI’s -component authentication norms. So without get entry to to your MPIN, your account is absolutely secure from the intruders.

Unified, Can money be remitted abroad using UPI?

Unified No, as of now only domestic transactions are permissible.

Is there an iOS or Windows Phone App for using UPI?

No, however according to the National Payment Corporation of India (NPCI). It will likely be to be had on different systems rapidly. As of now, it’s only to be had for Android customers. Considering Android has the most important market share in India.

Unified, Wrapping Off

UPI is the way ahead for the Indian economic system as there’s a scarcity of cash proper now. And also due to the fact it’s far a better opportunity to other E-wallets inclusive of Paytm. Mobikwik, Oxigen wallet, and many others.

Unified Over the course of time, it will prove to be a extremely good software for the public. Because it will make bills speedy. And smooth for the Billion plus populace of the world’s largest democracy, India.

Unified, Hope this article helped you clear a few doubts about UPI. If you’ve got any greater questions concerning UPI. Feel unfastened to invite them thru the feedback or tweet at me at once.